Lowest Refinance Rates

- Lowest refinance rates in us

- Lowest refinance rates 30-year

- Lowest refinance rates ever

- Lowest refinance rates mortgage

5% interest rate differential $ 250, 000 outstanding mortgage 3 remaining mortgage term $ 11, 250 interest savings at lower rate The major cost of refinancing is your mortgage breakage penalty, which is supposed to capture the lost revenue to your lender when you terminate your mortgage contract. On a fixed rate mortgage you will pay the greater of three months interest or interest rate differential. On a variable mortgage you will only pay three months' interest. Since our example involves a fixed mortgage rate, we must determine both 3 months' interest and the interest rate differential (IRD) and choose the greater. Step 2: Determine 3 months interest penalty months ÷ 12 $ 3, 125 3 months interest penalty Step 3: Determine interest rate differential (IRD) penalty ( 5. 00% 4. 05% current posted 3-year fixed rate) convert to monthly 0. 08% interest rate differential (IRD) IRD outstanding mortgage balance 36 months remaining in term $ 7, 200 Now that we have calculated both 3 months interest and the IRD, we see that the IRD is a bigger penalty, which will be used to calculate the refinance savings.

Lowest refinance rates in us

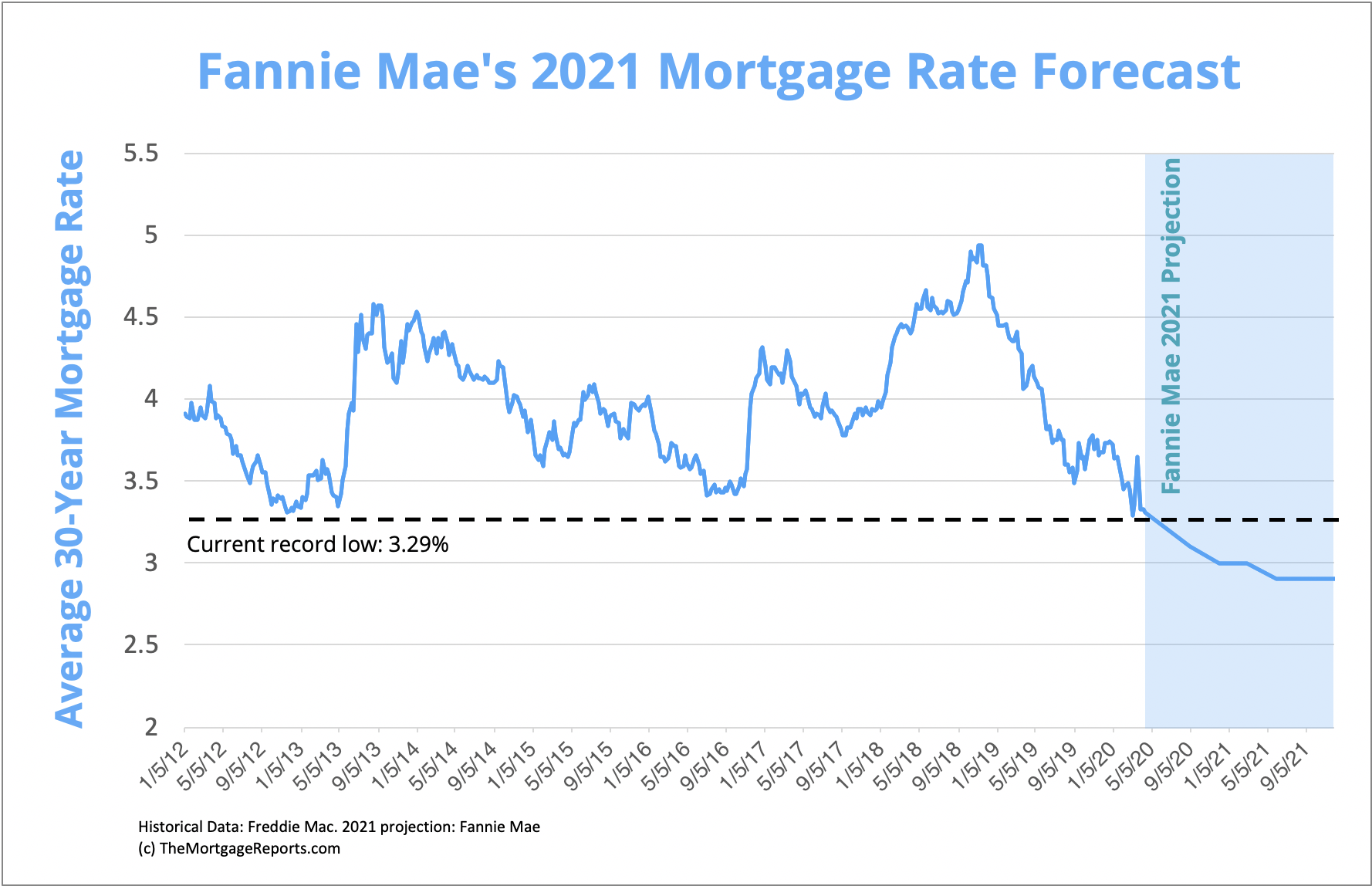

Fixed mortgage rates have dipped slightly since this time last week, and adjustable rates have stayed the same. Mortgage rates are down overall since this time last month. Overall, mortgage rates are at historic lows. The downward trend becomes more obvious when you look at rates from six months or a year ago: Rates from the Federal Reserve Bank of St. Lower rates typically signal a struggling economy. As the US economy continues to grapple with the coronavirus pandemic, rates will probably stay low. Rates from Bankrate. Refinance rates have held steady since last Tuesday, and they've dropped since November 29. With a 30-year fixed mortgage, you'll pay off your loan over 30 years, and your rate stays locked in for the entire time. You'll pay a higher interest rate on a 30-year fixed mortgage than on 15-year or 10-year fixed-rate mortgages. For a long time, you'd also pay a higher rate on a 30-year fixed loan than on a 5/1 ARM. But right now, 30-year fixed rates the better deal. Monthly payments are lower for 30-year terms than for shorter terms, because you're spreading payments out over a longer period of time.

Refinancing Reasons to Refinance One great reason to refinance your mortgage is to secure a lower mortgage rate, saving yourself money over time. Just ensure that your refinance penalty—which is calculated several ways—doesn't exceed your potential savings. Will you save at a lower interest rate? Let 's refinance calculator compare the savings against the cost of refinancing. Example savings through a refinance Let's look at a detailed calculation assuming you have a home valued at $350, 000 with an outstanding $250, 000 mortgage. You are two years into a five-year term with a fixed rate of 5. 0% and are considering a new five-year term at 3. 5%. Throughout the example we will examine refinance savings and costs. To evaluate the interest savings, you start by calculating the difference between mortgage rates. You then apply this to your mortgage balance for the remaining 3 years left in your 5-year term: Step 1: Determine interest savings 5. 0% existing mortgage rate 3. 5% new mortgage rate = 1.

You'll pay more in interest in the long term with a 30-year term than you would for a shorter term, because a) the rate is higher, and b) you'll be paying interest for longer. With a 15-year fixed mortgage, you'll pay down your loan over 15 years and pay the same rate the whole time. The 15-year mortgage rates are lower than 30-year mortgage rates. Between the lower rates and paying off the loan in half the time, you'll pay less in the long run on a 15-year mortgage than on a longer term. However, your monthly payments will be higher on a 15-year loan than on a 30-year loan. You're paying off the same principal amount in a shorter amount of time, so you'll pay more each month. It isn't very common to get a 10-year term for an initial mortgage, but you may refinance into a 10-year mortgage. Lenders charge similar interest rates on 10-year and 15-year terms, but you'll pay off your mortgage sooner with a 10-year term. With an adjustable-rate loan, your rate stays the same for the first few years, then changes periodically.

Lowest refinance rates 30-year

You may want to request a copy of your credit report to review your report for any errors. Save more for a down payment. Depending on which type of mortgage you get, you may not even need a down payment to get a loan. But lenders typically offer you a better rate when you have a bigger down payment. Because rates should stay low for a while, you probably have time to save more. Lower your debt-to-income ratio. Your DTI ratio is the amount you pay toward debts each month, divided by your gross monthly income. Many lenders want to see a DTI ratio of 36% or less, but the lower your ratio, the better your rate will be. To improve your ratio, pay down debts or consider opportunities to increase your income. If your finances are in a good place, you could land a low mortgage rate right now. But if not, you have plenty of time to make improvements to get a better rate. Laura Grace Tarpley is the associate editor of banking and mortgages at Personal Finance Insider, covering mortgages, refinancing, bank accounts, and bank reviews.

Lowest refinance rates ever

- Lowest refinance rates auto

- Lowest refinance rates trend

- Mutual funds philippines interest rates

- Hi, I'm Dave from BT Openreach. Your internet connection is really slow, can I have remote access to your router and all of the connected devices please. : britishproblems

- Lowest refinance rates.org

- Bachelors of general studies

- Lowest refinance rates 30-year

- Data web hosting jobs

- E procurement services

- Degree nursing online

- Lowest refinance rates.html

See the mortgage rates for Wednesday, April 14 2021 » Disclosure: This post is brought to you by the Personal Finance Insider team. We occasionally highlight financial products and services that can help you make smarter decisions with your money. We do not give investment advice or encourage you to adopt a certain investment strategy. What you decide to do with your money is up to you. If you take action based on one of our recommendations, we get a small share of the revenue from our commerce partners. This does not influence whether we feature a financial product or service. We operate independently from our advertising sales team.

Step 4: Determine savings through a refinance refinance penalty $ 4, 050 refinance savings Under this example, refinancing would give us $4, 050 in savings. Refinance at a lower rate Build a stronger financial future today: let connect you to Canada's best mortgage rates. Additional considerations In some cases you may be responsible for legal fees associated with registering a new mortgage on your property. As a general rule however, if your mortgage loan is between $250, 000 - $300, 000, your lender or broker will often cover legal fees. When refinancing to a lower mortgage rate, you should also consider using some of your equity to consolidate debt or finance other projects. As of July 9th, 2012 the maximum loan to value ratio on a refinance is 80%. For example, on a home worth $350, 000, you can have a mortgage of $280, 000 (80% * $350, 000). Comparing the $280, 000 to the existing mortgage balance of $250, 000, you can take an additional $30, 000. If you do have outstanding credit card debt, an auto loan or a personal line of credit at a higher interest rate, then you can combine all of this debt into your mortgage.

Lowest refinance rates mortgage

See the latest mortgage and refinance rates for Wednesday, December 30 » Mortgage rates haven't changed much since last Tuesday, but they're trending downward overall. If you want to buy a home soon, you may want to choose a fixed-rate mortgage over an adjustable-rate mortgage. Darrin English, Senior Community Development Loan Officer at Quontic Bank, told Business Insider that typically there's an advantage to an adjustable-rate mortgage, in which the rate fluctuates after an initial period. That advantage is usually a lower rate for the fixed period. However, he points out that ARMs don't currently follow that pattern. Fixed rates are currently better than adjustable rates, because lenders want to keep customers banking with them for as long as possible. Even though the 30-year fixed rate and 5/1 adjustable rate are about the same right now, you'd risk your 5/1 ARM rate increasing in five years, whereas you could lock in a low rate for decades with a 30-year term. Rates from the Federal Reserve Bank of St. Louis.

Your rate is locked in for the first five years on a 5/1 ARM, then your rate increases or decreases once per year. ARM rates are at all-time lows right now, but a fixed-rate mortgage is still the better deal. The 30-year fixed rates are comparable to or lower than ARM rates. It could be in your best interest to lock in a low rate with a 30-year or 15-year fixed-rate mortgage rather than risk your rate increasing later with an ARM. If you're considering an ARM, you should still ask your lender about what your individual rates would be if you chose a fixed-rate versus adjustable-rate mortgage. It could be a good day apply for a mortgage, but don't worry if you aren't ready just yet. Mortgage rates should stay low for months (if not years) so you'll likely have plenty of time to take advantage of low rates. To get the best mortgage rate possible, consider working to improve your finances. Here are some tips for snagging a low mortgage rate: Improve your credit score. Making all your payments on time is the most important part of boosting your score, but paying down debts and letting your credit age also help.