Basic Homeowners Insurance Policy

However, your personal property is still only covered for named perils. Insurance Terminology Property Covered Against Contents Covered Against HO-3 - Special Form Open perils Named perils HO-4 — Renters insurance Put simply, an HO-4 policy equates to renters insurance, which doesn't provide any coverage for the dwelling you're occupying as a tenant. Covered losses to your personal belongings are protected a named peril basis, and the policy also provides liability coverage and additional living expenses. Insurance Terminology Property Covered Against Contents Covered Against HO-4 - Renters Form No coverage for property Named perils HO-5 — Comprehensive form If you're looking for the broadest type of policy that will protect your home and personal property from any peril that isn't excluded in the policy, consider an HO-5 homeowners policy. Keep in mind that even open peril policies come with limitations; in fact, most natural disasters, like floods and earthquakes, are never covered by homeowners insurance.

Basic homeowners insurance policy

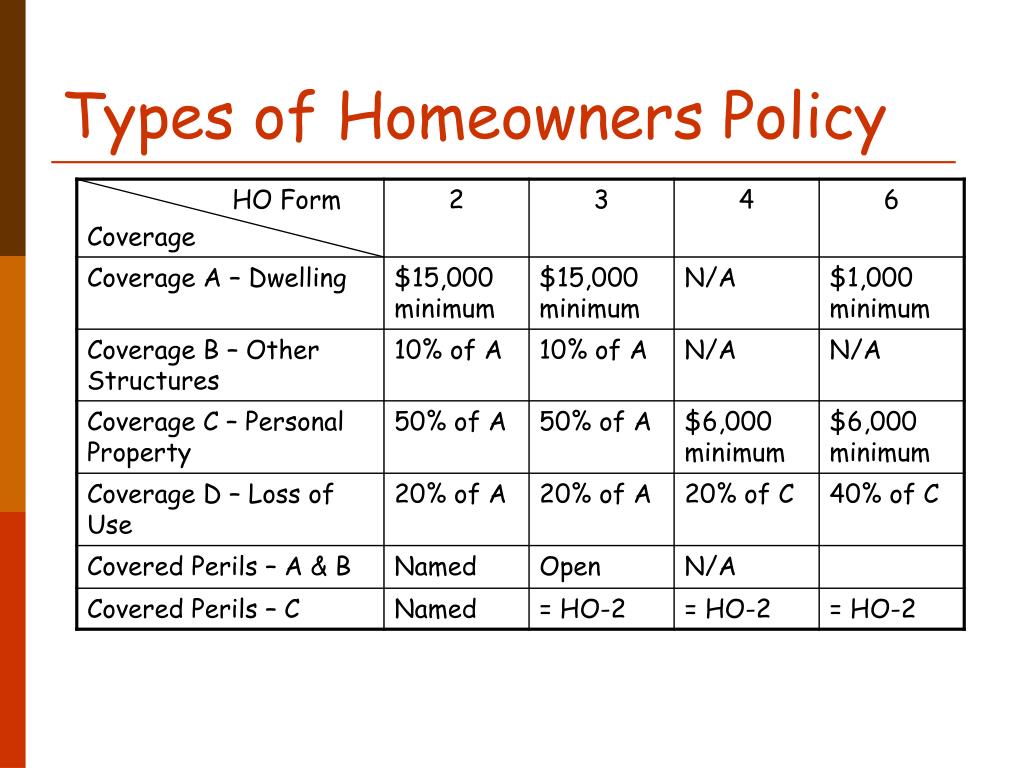

So Coverage A applies not just to the building itself, but also to items like stoves, ovens, refrigerators, air conditioning units and compressors, cabinets, and fixtures. Coverage B Is for structures that are not attached to the house. That could be a fence, utility shed, pool house, garage, a carport that is not attached to the house, or anything similar. Coverage C Is for all your personal property. This includes things like your furniture, clothes, TVs, and other electronic equipment. Coverage for some items, like guns, silverware, jewelry, and a few others are limited. If you have any of these items, you may want to consider a supplemental Scheduled Personal Property insurance. Coverage D Is called Loss of Use. This coverage pays for any additional costs for you to live somewhere else after you have a loss and cannot stay in your house. It pays for things such as hotel costs, additional costs above normal for meals, and any other expenses that would not normally arise if the loss had not occurred.

So if you have $100, 000 of coverage, between $10, 000 and $20, 000 would be deducted from your settlement. One final type of homeowners insurance you might consider adding to your policy is sewer backup and flooding insurance. Typical homeowners policies won't pay for sewer-related plumbing, and this can be a big deal if you live in an area with an old sewer system. You can ask your insurer about adding sewer coverage to your typical homeowner's insurance policy for an additional premium. What About the Amount of Protection Provided? The covered hazards are just one major component of homeowners insurance policies. The other major component is the amount of protection your homeowner's insurance policy provides. Typical policies will include a payout limit for your actual home and its structure, as well as a payout limit for your personal property. If you have a personal liability policy, that policy's limit will be stated separately, as well. But knowing the dollar amount isn't enough.

- Basic homeowners insurance policy center

- Basic renters insurance policy

- Bank of the philippines bank code

- Hair salons franchise

- Basic Homeowners Insurance | UPC Insurance

- Top-10 Worst Sports Injuries Of All Time | SportyTell

- Professional property management of northern virginia patient portal

- Cefalu Tourism 2021: Best of Cefalu, Italy - Tripadvisor

Basic homeowners insurance policy.org

The issue of a resident spouse involves the husband or wife of a party who is the sole legal owner of the home. Some insurers list the spouse as a named insured even though the spouse's name does not appear on the deed. Resident spouse is a term that does not name the person and requires the spouse to live in the home to be insured. Other Insureds Other insureds is a catch-all category. A common example is children of any age residing in the home. Other insureds include any relatives such as a parent or sibling who live in the home. Each is covered under both the personal property sections and comprehensive liability provisions. Unrelated persons under age 21, like foster children, also receive the same coverage. An employee of the owner, such as a housekeeper, is covered solely by the personal property provision. Guests and visitors are only covered for personal property if that coverage is requested when the homeowners policy is purchased. Off-Premise Coverage The homeowner rents a church or municipal building for a reception.

And you should also understand under what circumstances an event is covered. For instance, if you lose power and your pipes freeze and burst, the related water damage may be covered. But if you take on water damage because of a neglected issue you knew about for a while, that may not be covered. Again, this is why you need to be sure that you talk with your insurance agent about the details of your policy. And, of course, practice proper home maintenance to avoid long-term, avoidable damage. What About Floods and Earthquakes? You may notice that even the most comprehensive types of homeowners insurance coverage specifically exclude natural events like floods and earthquakes. That's because these cataclysmic disasters often cause a lot of loss in a short amount of time. Insurance companies have trouble absorbing these losses. Flood Insurance Because of this, the federal government has a flood insurance program that offers insurance against this specific event. You can buy this insurance through the National Flood Insurance Program.

The Basic Types of Homeowners Insurance Policies Insurance companies have their own shorthand for different types of standard homeowners insurance policies. There are eight basic types. While they can vary from company to company, these eight types describe the kinds of hazards a policy protects you from. Here's a quick overview of the basic options and the types of hazards they cover: Policy Type Hazards Protected Other Details HO-1 (Basic Form) HO-2 (Broad Form) HO-3 (Special Form) HO-4 (Tenant's Form) HO-5 (Comprehensive Form) HO-6 (Condo Form) HO-7 (Mobile Home Form) HO-8 (Older Home Form) Pricing wise, you can get an idea by comparing quotes on the platform of Policygenius or generating a custom-tailored policy with Lemonade The important thing to note about all these types of homeowners insurance is that they vary from policy to policy. Most HO-2 policies will cover the same hazards. Most HO-3 policies will exclude the same hazards. But your policy may have slight differences. This is why it's so important to ask your insurance company about the specifics of your policy.

Replacement Cost Coverage The replacement cost of your home is the amount of money it would take to build the same home in today's market. So maybe you paid $150, 000 for your home. But if it burns to the ground and labor and materials are now more expensive, it might cost $175, 000 to rebuild. This is the type of homeowners coverage you should look for. If your home is a total loss due to a covered event, you'll be able to rebuild with similar space, features, finishes, and fixtures. Keep in mind when calculating the amount of coverage you need that you don't need to count the value of your lot in replacement costs. When you buy your home, you also buy the land it sits on. And you won't have to replace that even in the case of a total loss. Guaranteed/Extended Replacement Cost This is a common option for homes with special features or historic homes. Because of their special features, such as hand-hewn flooring or detailed woodworking, they can be very expensive to replace. In fact, they may cost much more to replace than their actual market value.